And the results are in - Gartners Magic Quadrant for Cloud IaaS 2017

Magic Quadrant for Cloud Infrastructure as a Service 2017

The latest Gartner analysis on the Cloud IaaS is out and there are few interesting pointers and easily worth your time to read it through, if the area is of interest to you. AWS has also bought the distribution rights to this paper, so if you want to access the whole study, you can do it here:

https://pages.awscloud.com/mq-download-report.html

The quadrant

For those of you, who are not familiar with the concept, the Magic Quadrant is a market research conducted by Gartner research group.

The quadrant for Cloud IaaS itself this year looks like this:

AWS is named as the leader now 7th consecutive year in a row. Just for comparisons sake, here are the previous two quadrants, so nothing much between the positioning of the leaders has changed in the last few years.

2015

2016

We will dive a bit deeper to this analysis in a bit, but first some other sources of information about current market.

Market shares

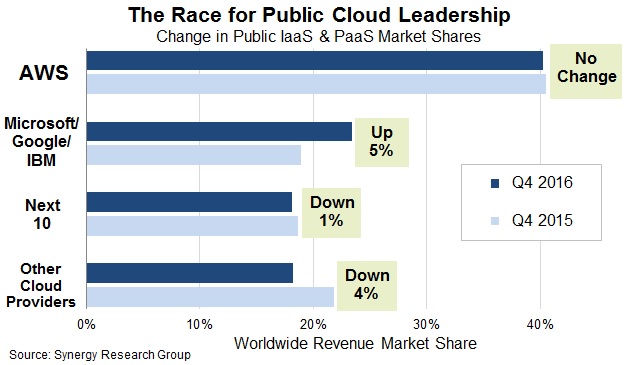

Based on Synergy’s research, AWS dominates the revenue share of the market as well in IaaS and PaaS offerings. In purely IaaS offering, AWS domination is even stronger and it holds approximately half of the current market.

The following diagram also illustrates, the “Next Three” are growing, but not in the expense of AWS market share, rather than the smaller ones are losing share even more.

Synergy estimates that annual public cloud IaaS and PaaS revenues have now reached well over $28 billion and continue to grow at almost 50% per year.

Synergy’s analyst told TechCrunch just recently that:

“Just from a pure math perspective, AWS is so far ahead of the rest that no-one can seriously challenge its leadership in the short term”.

At least for now, the leadership has proven to provide more innovation and not lack of it.

In market share, in relative figures, Azure is growing faster right now, but in absolute numbers, AWS is still the number one in that field. But to keep in mind, that if you are huge already, relative growth in the same pace as for much smaller companies becomes pretty soon impossiblity.

Some key findings

I’m concentrating here to comment on some key items about AWS and Azure, as those are the most relevant for me personally, and even in global scale, as Gartner puts it:

“Gartner estimates that Google Cloud Platform is a distant third in cloud IaaS and integrated IaaS+PaaS market share”

Not just the Quadrant itself, but also the written analysis have pretty clear message. AWS and Azure are the market leaders, as well as innovation leaders. Based on Gartner’s analysis, Google is also often chosen as the secondary cloud provider (for portable infrastructure) and its feature set and scope of services are not as broad as that of the market leaders.

And it is pretty clear that everyone else is far behind, both in market shares and in feature set and the pace of innovation.

Gartner considers AWS and Azure both to be clearly mature Tier 1 providers with feature sets directed to both Mode 1 and Mode 2 organizations and services, according to their bimodal classification. Probably AWS interests currently a bit more Mode 2 type of organizations and Azure a bit more Mode 1 type of organizations, Azure being in the focus especially if the organization has strong Microsoft technology stack already in use. In any case, both have the capabilities of serving organizations and services operating in both modes.

This conclusion is also reflected in the “Recommended uses”, where Azure is recommended for cloud adoption of already existing Microsoft centric stack

In the innovation department, Gartner states that AWS is the clear market leader and is considered as the reference point for all competitors, with an accelerating pace of innovation, but also emphasizes that this is gradually changing.

Microsoft is now launching innovative Azure capabilities of its own, rather than primarily copying competitor capabilities.

The pace of innovation can be also a challenge, as it is pretty hard to keep up with all the new features and advanced functionality. The best architecture you could plan half a year ago might be medicore solution right now, when new features have been announced.

One difference between AWS and Azure is that Azure works currently in greater number of local markets with bigger number of facilities (currently 34 regions) than AWS (currently 16 regions). It remains to be seen, if this is going to change or if this even matters in the long run. We are going to be much wiser in the future about the importance of the local presence after the AWS Stockholm site opens in 2018. At least I’m pretty sure it won’t slow down the cloud adoption in the Nordic market.

One interesting point is that both operate also in China, but through a local subsidiary / partner company. Apparently that is the only way to operate on that market currently in any way. And the one interesting note is the possible significance of Alibaba Cloud in the IaaS market in upcoming years. This is the first year it is featured in this analysis and as a complete newcomer to a market outside China, it has been valued pretty highly in the analysis.

So what is the conclusion?

Bigger is not necessarily always better. But economics of scale and the pace of innovation proven by the top players in the Gartner analysis have proven track record right now, which are the players where you would probably want to bet on.

Personally, I have concentrated the most on the AWS stack and secondarily to Azure stack. For me - and my employer - it has proven to be the right choice. Yours might differ and be the right for you.

One last finding from Gartner is that moving between IaaS providers is challenging. So choose wisely.